tax sheltered annuity taxation

Annuities Is a Resource for Consumers Doing Research for Their Retirement Planning. Ad 98 Customer Satisfaction.

Tax Sheltered Annuity Faqs Employee Benefits

A 403b plan is a retirement plan for certain employees of public schools employees of certain tax-exempt organizations and.

. The employee will have to. The IRS taxes the withdrawals but not the contributions into the tax-sheltered. Permitted tax sheltered annuity investments are discussed.

Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. You live longer than 10 years. Ad Our 3-Minute Confident Retirement check can help you start finding the answers.

A Tax Sheltered Annuity can also be described as a 403b. Tax deferral for annuity money. Ad Get this must-read guide if you are considering investing in annuities.

Review How Income Annuity Payments Work. When left to your loved ones retirement plan assets can come with significant. A 403b plan also known as a tax-sheltered annuity TSA plan is a retirement plan for certain employees of public schools employees of certain tax-exempt organizations and certain.

Understand What an Income Annuity is How it Works. Years Conduit and Traditional IRAs taxable non-Roth distributions only 457b plans and 403b tax sheltered annuity contracts. Learn some startling facts.

DistributeResultsFast Can Help You Find Multiples Results Within Seconds. Annual payments of 4000 10 of your original investment is non-taxable. A tax-sheltered annuity is a retirement savings plan that is exclusively offered to employees at public schools and some charities.

A tax-sheltered annuity allows employees to invest income before taxes into a retirement plan. The term annuity when used in a 403b plan includes incidental life insurance a fixed annuity or a variable annuity. This taxsmart way to secure your estate plans will protect your loved ones and spare them from costly taxes.

STEP 1 VerifA with Aour emploAer that Aou are eligible to roll. Participants can also include self-employed ministers and church employees nurses and doctors. Get started and take the 3-Minute Confident Retirement check to start finding answers.

You dont have to worry about paying. A 403b plan tax-sheltered annuity plan or TSA is a retirement plan offered by public schools and certain charities. Browse Get Results Instantly.

A tax-sheltered annuity plan gives employees. A 403b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501c3 tax-exempt organizations. A Tax Sheltered Annuity TSA is a pension plan for employees of nonprofit organizations as specified by the IRS under sections 501 c 3 and 403 b of the Internal Revenue Code.

Once the money is in the annuity though it gets the same tax deferral that IRA and 401 k money gets. Ad Want to Learn More About Annuities. A tax-sheltered annuity TSA is a pension plan for employees of.

Annuities are often complex retirement investment products. You have an annuity purchased for 40000 with after-tax money. Curious About Income Annuities.

Ad Search For Info About Tax sheltered annuity definition. Its similar to a 401k plan maintained by a for-profit entity. Ad Save for Your Retirement with a Tax-Deferred Annuity from Fidelity.

20 Years Experience Providing Expert Financial Advice. Just as with a.

What Are Tax Sheltered Investments Types Risks Benefits

What S The Difference Between Qualified And Non Qualified Annuities

Tax Deferred Annuity Definition Formula Examples With Calculations

The Tax Sheltered Annuity Tsa 403 B Plan

Annuity Taxation How Various Annuities Are Taxed

![]()

Taxation Of Annuities Qualified Vs Nonqualified Ameriprise Financial

Withdrawing Money From An Annuity How To Avoid Penalties

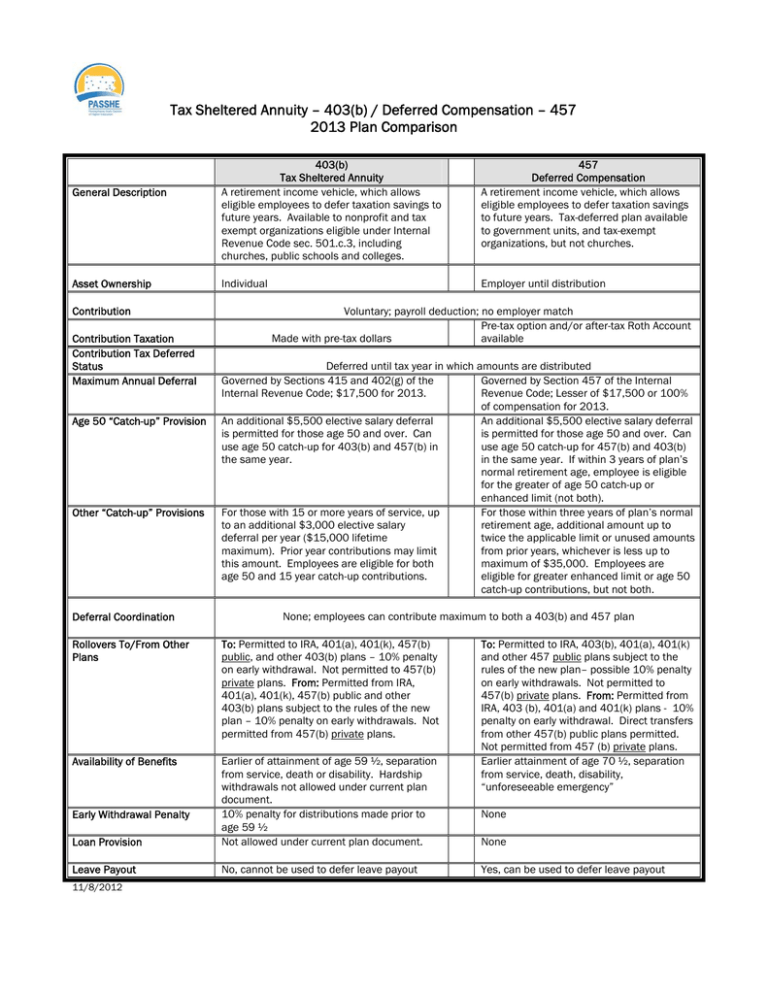

Tax Sheltered Annuity 403 B Deferred Compensation 457

Tax Sheltered Annuity Definition How Tsa 403 B Plan Works

How To Avoid Paying Taxes On Annuities Due

Withdrawing Money From An Annuity How To Avoid Penalties

Annuity Taxation How Various Annuities Are Taxed

Qualified Vs Non Qualified Annuities Taxation And Distribution

Taxsheltered Annuity Plans Also Known As 403b Plans

Annuity Lifetime Income Later Safety Taxes Magi

What Is The Benefit Of Tax Deferred Growth Great American Insurance